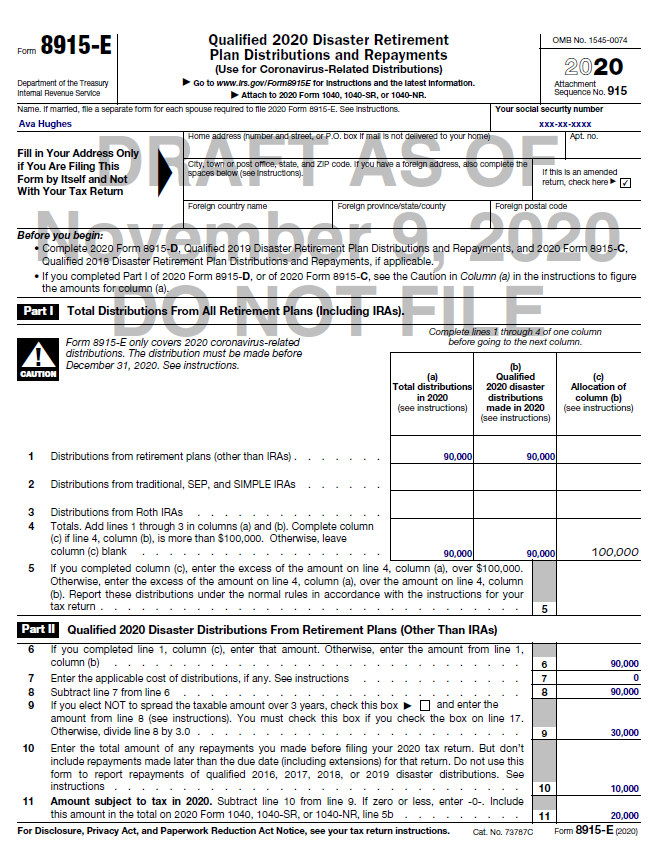

8915-e tax form instructions

The 8915-E is for entering and tracking coronavirus-related retirement plan distributions. If you are not required to file an income tax return but are required to file Form 8915-E fill in the address information.

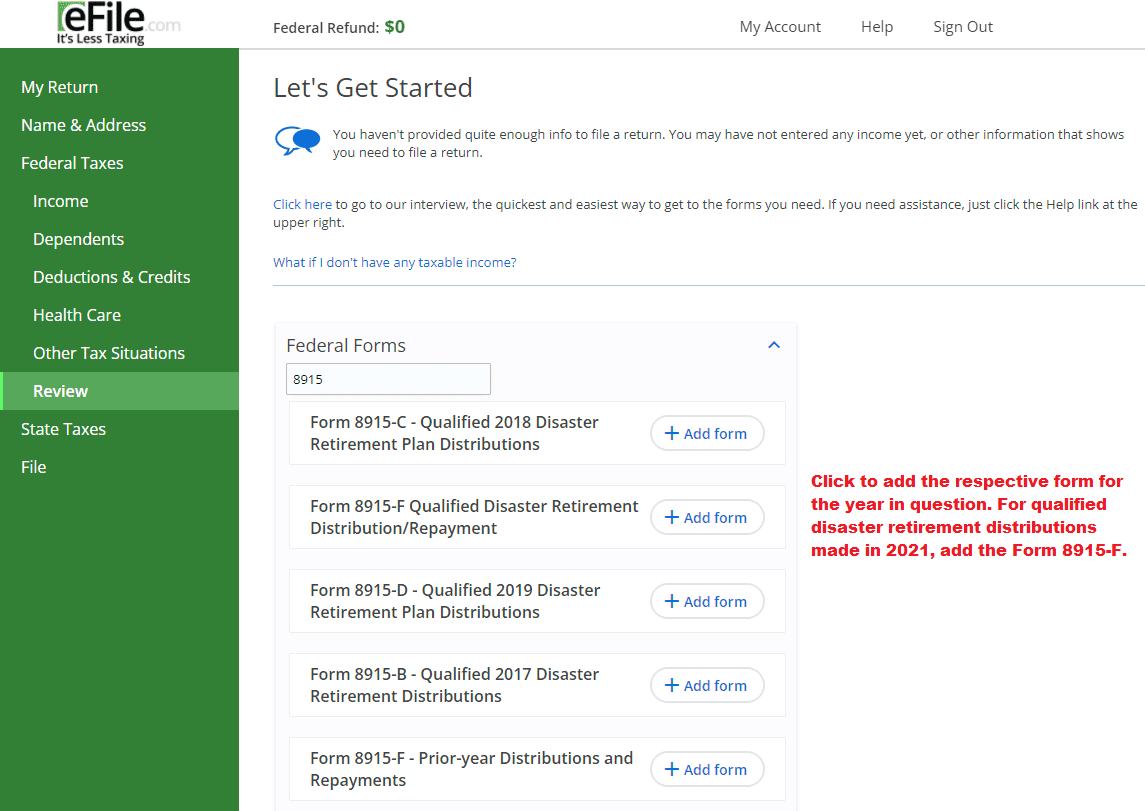

Tax Year 2021 Irs Forms Schedules Prepare And File

Form 8915-E lets you report the penalty-free distribution.

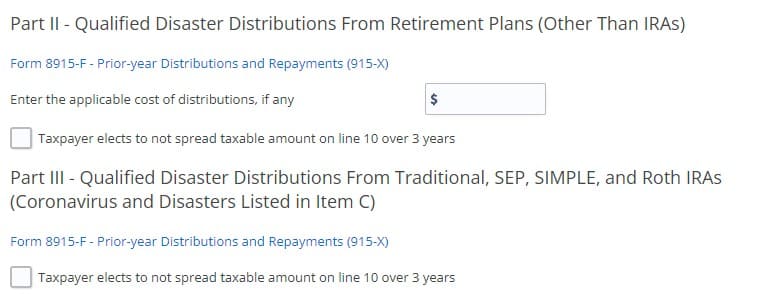

. For instructions on how to complete Form 8915-E in the ProWeb program please click the PDF at the bottom of this page. File 2020 Form 8915-E with your 2020 Form 1040 1040-SR or 1040-NR. This form replaces Form 8915-E for tax years beginning after 2020.

9 rows Instructions for Form 8915-D Qualified 2019 Disaster Retirement Plan Distributions and Repayments. Attach to 2020 Form 1040 1040-SR or 1040-NR. Qualified Disaster Retirement Plan Distributions and Repayments Forms 8915-A 8915-B 8915-C 8915-D and 8915-E are available in Drake Tax.

You can qualify for a penalty-free distribution if you. In this post you can learn more about Form 8915-E including qualified disaster distribution details instructions for Form 8915-E and how to get help completing the form. If eligible complete and file Form 8915-E to report the distribution.

Tax act form 8915-e. Download or print the 2021 Federal Form 8915-E Qualified Hurricane Retirement Plan Distributions and Repayments for FREE from the Federal Internal Revenue Service. If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions.

Qualified Disaster Retirement Plan Distributions. For instructions and the latest information. If you used Worksheet 2 in your 2020 Instructions for Form 8915-E the amount for line 1b is figured by.

All forms are printable and downloadable. That Typically takes the IRS 2-3 weeks. Instructions 8915 Form 2019-2022.

Download or print the 2021 Federal Form 8915-E Qualified Hurricane Retirement Plan Distributions and Repayments for FREE from the Federal Internal Revenue Service. If married file a separate form for. In tax year 2020 this form is used to elect to spread the distributions over three.

Once completed you can sign your fillable form or send for signing. Qualified 2020 Disaster Retirement Plan Distributions and Repayments which is used for COVID-related early distributions will be. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor.

See below for a link to sign up for an email when the form is ready. Plan Distributions and Repayments Qualified 2020. The TurboTax 8915-E should be available on Feb.

The form will be ready soon. Form 8915-E is used by taxpayers who were. Per the instructions Use Form 8915 if.

Individual Retirement Accounts Reporting Repayments Of Coronavirus Related Distributions Wolters Kluwer

Irs Issues Form 8915 E For Reporting Qualified 2020 Disaster Distributions And Repayments Provides 2020 Forms For Earlier Disasters

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

8915 E Form Fill Online Printable Fillable Blank Pdffiller

M O Cpe The Definitive Tax Seminar

Irs Warns Of Delays And Challenging 2021 Tax Season 10 Tax Tips For Filing Your 2020 Tax Return

Fillable Online Form 8898 Rev October 2020 Statement For Individuals Who Begin Or End Bona Fide Residence In A U S Possession Fax Email Print Pdffiller

National Association Of Tax Professionals Blog

Irs Issues Form 8915 F For Reporting Qualified Disaster Distributions And Repayments Provides 2021 Forms For Earlier Disasters

1040 1099 R Distribution Amounts Doubling 1099r

Coronavirus Related Distributions Via Form 8915

Coronavirus Related Distributions Via Form 8915

Cares Act Retirement Distributions Reporting Form 8915 F 2021 From 2020 Irs Form 8915 E Youtube

Use Form 8915 E To Report Repay Covid Related Retirement Account Distributions Don T Mess With Taxes

Tax Form Focus Irs Form 1099 R Strata Trust Company

A Guide To The New 2020 Form 8915 E

Fill Free Fillable Irs Pdf Forms

Use Form 8915 E To Report Repay Covid Related Retirement Account Distributions Don T Mess With Taxes

Hhs Issues Faqs On Electronic Processing Of National Medical Support Notices